Swing Trading: A Comprehensive Guide to Profiting from Market Swings

Swing trading is a versatile trading strategy that aims to capture short- to medium-term price movements in the stock market. This article will explore what swing trading is, how it works, and the key strategies and tools traders use to profit from market swings.

What is Swing Trading?

Swing trading involves holding a position—whether long or short—for several days to a few weeks to profit from expected price movements. Unlike intraday trading, where positions are closed within the same day, swing traders look to capture more significant price swings in stocks, commodities, or other financial instruments.

Key Features of Swing Trading

- Holding Period: Swing trades typically last from a few days to several weeks.

- Moderate Time Commitment: Swing traders don’t need to monitor the market constantly, making it ideal for part-time traders.

- Profit from Market Fluctuations: The goal is to benefit from upward or downward swings in the price of a stock or asset.

Advantages of Swing Trading

- Less Time-Intensive: Unlike day trading, swing trading doesn’t require constant market monitoring, making it suitable for those with other commitments.

- Higher Profit Potential: By holding positions longer, swing traders can capture larger price movements.

- Flexibility: Swing traders can profit in both rising and falling markets.

Popular Swing Trading Strategies

Swing traders use a variety of strategies to time their entries and exits. Here are some of the most commonly used techniques:

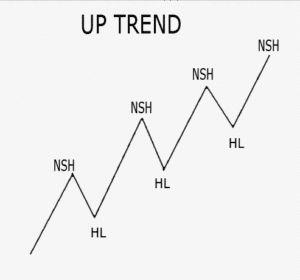

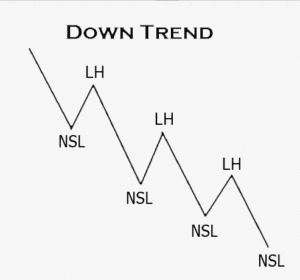

1. Trend Trading

- Concept: This strategy involves identifying and trading in the direction of a well-established trend, whether uptrend or downtrend.

- Example: A swing trader may go long (buy) a stock that is in an uptrend, expecting the price to continue rising, or short-sell a stock in a downtrend.

2. Breakout Trading

- Concept: Entering a trade when the price breaks out of a defined range or key technical level (support or resistance).

- Example: If a stock breaks above its resistance level with strong volume, a breakout trader would buy, expecting further upward momentum.

3. Pullback Trading

- Concept: A pullback strategy involves entering a trade after a temporary price dip (in an uptrend) or bounce (in a downtrend).

- Example: In a strong uptrend, a swing trader may wait for a slight pullback to a support level before buying, aiming to catch the next leg up.

4. Reversal Trading

- Concept: Traders using this strategy look for points where a prevailing trend might reverse direction.

- Example: If a stock shows signs of a bullish reversal after a prolonged downtrend, a swing trader may buy in anticipation of an upward move.

5. Moving Average Crossover

- Concept: This strategy is based on the crossover of short-term and long-term moving averages. When a shorter moving average crosses above a longer moving average, it signals a potential buying opportunity.

- Example: A swing trader might buy when the 50-day moving average crosses above the 200-day moving average, signaling a bullish trend.

Swing Trading Tools and Indicators

Successful swing traders use a variety of technical indicators and tools to guide their decisions:

- Moving Averages (MA): The 50-day and 200-day moving averages are commonly used to identify long-term trends.

- Relative Strength Index (RSI): RSI helps traders identify overbought or oversold conditions. A reading above 70 indicates overbought conditions, while below 30 suggests oversold.

- MACD (Moving Average Convergence Divergence): MACD is a momentum indicator that reveals the strength and direction of a trend.

- Bollinger Bands: These measure volatility and help traders identify potential price breakouts or reversals.

- Fibonacci Retracement: Fibonacci levels (23.6%, 38.2%, 50%, 61.8%) are used to predict potential support and resistance levels.

Risk Management in Swing Trading

Like any trading strategy, risk management is crucial in swing trading to avoid significant losses. Here are some key risk management practices:

- Stop-Loss Orders: Setting stop-loss levels ensures that if the price moves against you, your losses are minimized.

- Position Sizing: Never risk more than 1-2% of your total trading capital on a single trade. Calculating your position size is key to managing risk.

- Risk-to-Reward Ratio: Swing traders aim for a favorable risk-to-reward ratio, such as 1:2 or 1:3. This means they are willing to risk ₹1 to make ₹2 or ₹3.

How to Choose the Right Stocks for Swing Trading

Selecting the right stocks is essential for swing trading success. Here are some factors to consider:

- Liquidity: Choose stocks with high liquidity to ensure smooth trade execution. Highly liquid stocks typically have lower bid-ask spreads, making it easier to enter and exit positions.

- Volatility: Swing traders look for stocks with moderate volatility to ensure there is enough price movement to profit from.

- News and Earnings Reports: Stocks that are about to release earnings reports or are affected by major news tend to have significant price swings, offering potential trading opportunities.

Pros and Cons of Swing Trading

Pros:

- Flexibility: Swing trading offers the flexibility to hold trades for days or weeks, allowing traders to capitalize on larger price movements.

- Moderate Time Commitment: Since trades are held for longer periods, swing traders don’t need to be glued to their screens all day.

- Profit in Any Market Condition: With the right strategy, swing traders can profit in both rising and falling markets.

Cons:

- Overnight Risk: Unlike intraday trading, swing traders are exposed to overnight market risks, such as unexpected news or economic events.

- Requires Patience: Swing trading requires the patience to wait for the right entry and exit points, which may take days or weeks.

- Risk of Gaps: Prices can gap up or down overnight or after weekends, leading to unexpected losses or missed profit opportunities.

Example of a Swing Trade

Let’s say a stock is trading at ₹500 and has been in an uptrend for several weeks. The stock pulls back to ₹480, a key support level, where the swing trader enters a long position. The trader sets a stop-loss at ₹470 (to limit potential losses) and a target price at ₹540. If the price moves up as expected, the trader exits at ₹540, securing a ₹60 profit per share.

Swing Trading vs. Intraday Trading: What’s the Difference?

While both strategies aim to capitalize on short-term price movements, there are key differences between swing trading and intraday trading:

- Time Horizon: Swing traders hold positions for days or weeks, while intraday traders close positions within the same day.

- Risk Exposure: Swing traders are exposed to overnight and weekend risk, while intraday traders avoid this by closing trades before the market closes.

- Time Commitment: Intraday trading requires constant attention, while swing trading is more flexible.

Conclusion: Is Swing Trading Right for You?

Swing trading offers an excellent balance between risk and reward for traders who can’t dedicate all day to the markets. With a solid understanding of trends, technical indicators, and risk management, swing trading can be a profitable strategy. However, traders must be prepared for overnight risks and exercise patience in waiting for the right trade setups.